Gareth Says – “It’s ISA Time!”

Well, it certainly feels, from a stock market perspective, that markets are progressing nicely. Markets always perform ahead of the economy due to their predictive nature.

You have five weeks to undertake an ISA in this tax year, if you have not used your allowance yet. If you have, then in five weeks’ time, we enter a new tax year, you will be able to invest £20,000 for the 2021/22 tax year.

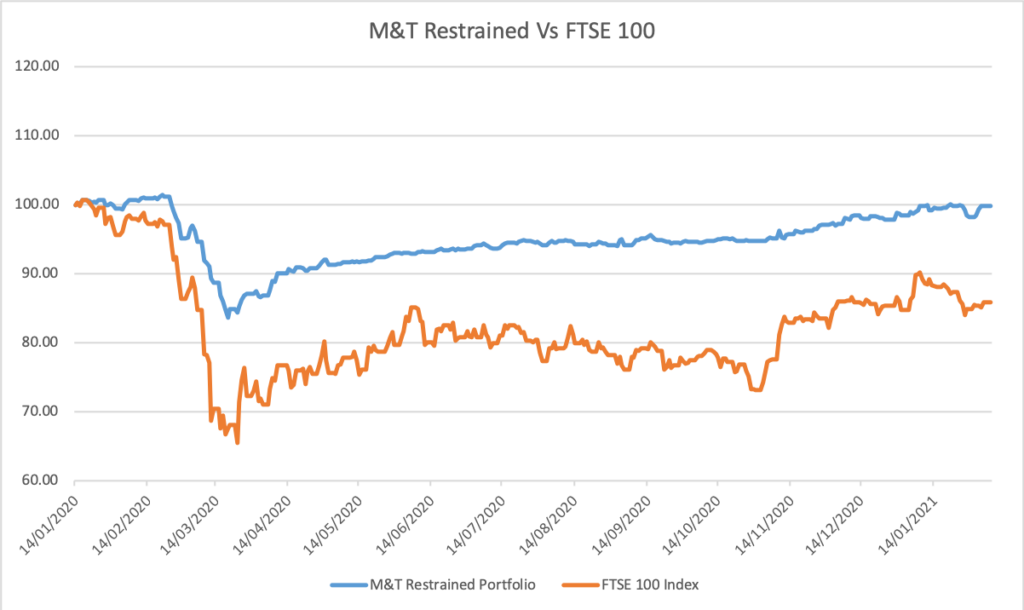

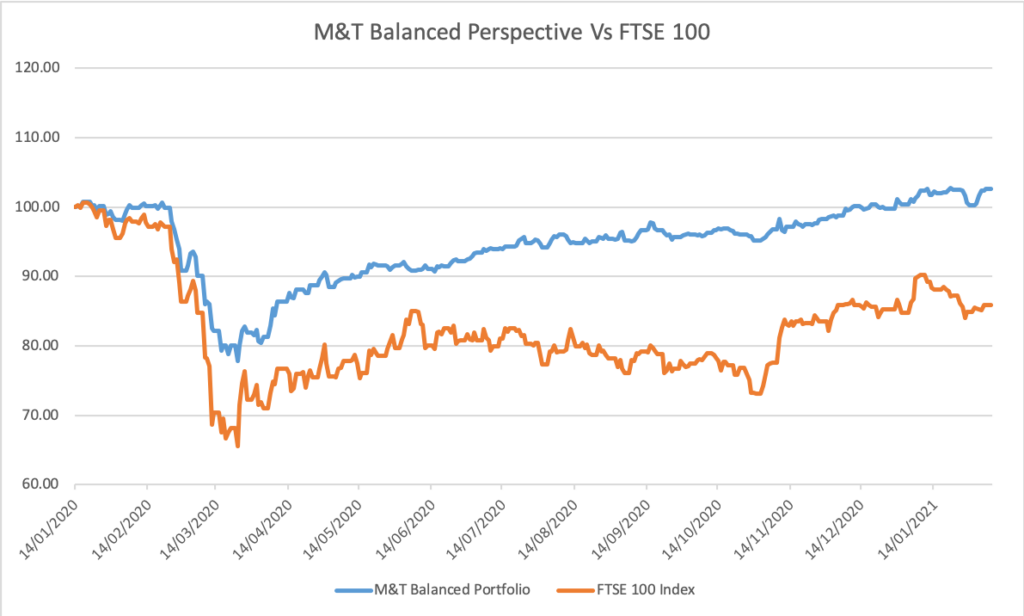

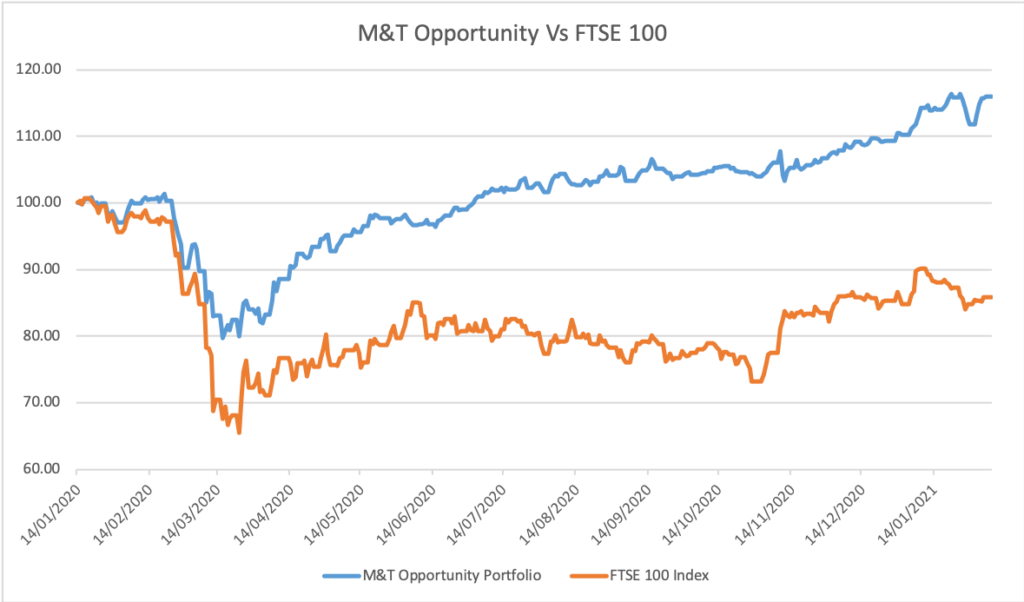

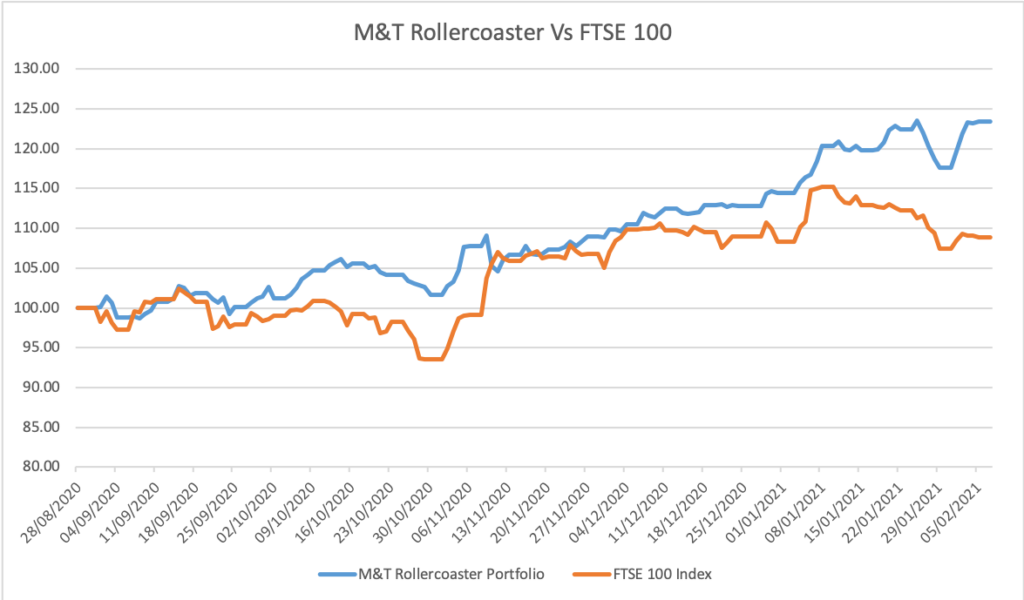

It’s just over a year since we launched our Discretionary funds – so how have they done? “Quite well”, I hope will be the consensus.

It has obviously been a difficult year for markets, but with some astute fund choices and holding of our nerve we have achieved the results below. We have four risk rated funds – “Restrained” which is low risk, “Balanced Perspective” which is medium risk, “Opportunity” which is medium to high risk and “Rollercoaster” which is high risk and will remain invested when the other funds may go into cash – we will not have many clients invested in this. It only launched in September.

If you want to know where the portfolios are invested, please visit the Morfitt & Turnbull website: www.morfittandturnbull.com, then scroll down to ‘M&T Portfolio’s’ – click on the tile and put in the password ‘gareth’ (all lower case) and you will be able to see the current profile along with a list of switches that we have made in the last twelve months.

Here are some ISA recommendations for 2020/21 and 2021/22 Tax years:

1. Lower Risk

a. M&T Restrained

or b. Prudential Cautious or Growth

2. Medium Risk

a. M&T Balanced Perspective

or b. Baillie Gifford Managed or Schroder Managed Balanced

3. Medium to High Risk

a. M&T Opportunity

Or b. L&G Global Robotics or Sanlam Artificial Intelligence

4. High Risk

a. M&T Rollercoaster

or b. Baring Korea or Baillie Gifford China

If you want to invest you can ‘phone 01565 624370 to discuss with your usual consultant. Stuart Tabeart’s replacement is Nick Dodd.

Gareth.